Cryptocurrency is a digital asset that is used as a medium of exchange. It is decentralized and does not have any physical form. It is based on blockchain technology and is secured by cryptography. The value of cryptocurrency is determined by the market forces of demand and supply. As the cryptocurrency market has grown over the years, the need to track and measure certain metrics has become increasingly important. One such metric is the total value locked (TVL). In this blog article, we will discuss what TVL is, its purpose, how to calculate it, and how to use it to make investment decisions.

What is Total Value Locked (TVL)?

Total Value Locked (TVL) is a metric used to measure the total amount of money that is locked up in a cryptocurrency project or system. TVL is often used to measure the success of a project and can be used to compare different projects. It is a measure of how much money is invested in a particular cryptocurrency project, and it is calculated by taking the total number of tokens held by investors and multiplying it by the current market price of the token. TVL can also be used to measure the liquidity of a project and the amount of capital being invested into it.

What is the Purpose of TVL?

The purpose of TVL is to provide investors with an indication of how much money is locked up in a particular project. It is a metric that can be used to compare different projects and to understand the financial health of a project. TVL is a valuable metric because it helps investors to make informed decisions when it comes to investing in a particular project. Furthermore, it provides an indication of the liquidity of a project and the amount of capital being invested into it.

Factors Affecting the Total Value Locked in Crypto

When it comes to the total value locked in crypto, there are a number of factors that can affect it. These factors include the number of tokens held by investors, the current market price of the token, the liquidity of the project, the amount of capital being invested into the project, and the performance of the project. By taking into account these factors, investors can get a better understanding of how much money is locked up in a project and how it is performing.

Measuring the Total Value Locked

Measuring the total value locked in crypto is an important part of understanding the financial health of a project. By measuring the total value locked, investors can get an indication of how much money is invested in a project, how much liquidity it has, and how it is performing. Furthermore, it can provide investors with insight into the potential investment opportunities of a project.

How to Calculate the Total Value Locked

Calculating the total value locked in crypto is relatively straightforward. The first step is to find out the total number of tokens held by investors. This can be done by looking at the token’s circulating supply. The next step is to find out the current market price of the token. This can be done by looking at the token’s market capitalization. Finally, the total value locked can be calculated by multiplying the total number of tokens held by investors by the current market price of the token.

Benefits of Tracking the Total Value Locked

Tracking the total value locked in crypto can provide investors with a number of benefits. It can provide investors with an indication of how much money is invested in a particular project, how much liquidity it has, and how it is performing. Furthermore, it can provide insight into the potential investment opportunities of a project. By tracking the total value locked, investors can make more informed decisions when it comes to investing in a particular project.

How to Use TVL to Make Investment Decisions

By tracking the total value locked in crypto, investors can make more informed investment decisions. The total value locked in a project can be used to compare different projects and to get an indication of how much money is invested in a particular project, how much liquidity it has, and how it is performing. Furthermore, it can provide insight into the potential investment opportunities of a project. By taking into account the total value locked, investors can make better decisions when it comes to investing in a particular project.

Challenges with Tracking the Total Value Locked

Tracking the total value locked in crypto can be challenging. It requires understanding the various factors that can affect the total value locked, such as the number of tokens held by investors, the current market price of the token, the liquidity of the project, and the performance of the project. Furthermore, it requires being able to accurately measure and track these factors in order to get an accurate indication of the total value locked in a project.

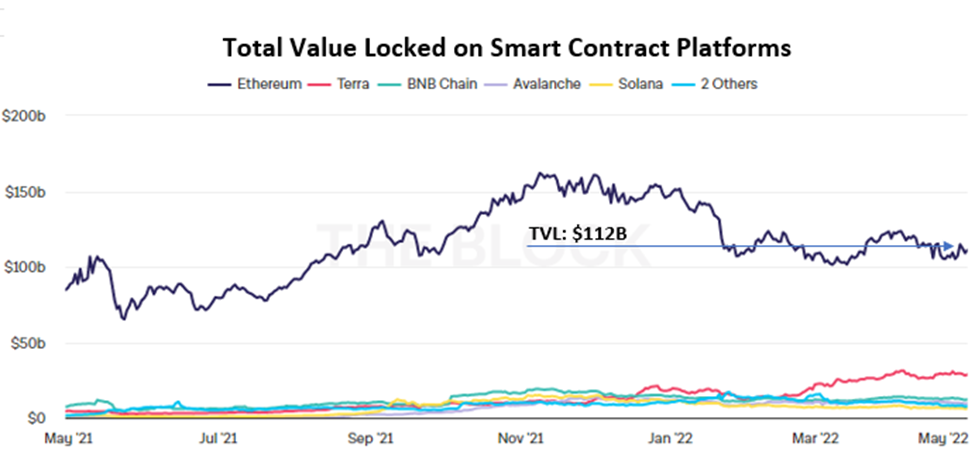

Examples of Crypto Projects with High Total Values Locked

There are a number of cryptocurrency projects that have high total values locked. For example, Ethereum has a total value locked of over $1 billion. Similarly, DeFi projects such as Compound, Aave, and Maker have a total value locked of over $2 billion. These projects have seen significant growth in their total value locked, indicating that they are popular with investors and have a high amount of liquidity.

Conclusion

In conclusion, total value locked (TVL) is an important metric to track when it comes to understanding the financial health of a particular cryptocurrency project. It provides investors with an indication of how much money is invested in a project, how much liquidity it has, and how it is performing. Furthermore, it can provide insight into the potential investment opportunities of a project. By tracking the total value locked, investors can make more informed decisions when it comes to investing in a particular project.